Podcast Introduction

In this podcast, Legal Tax Junkie Adam Abrahams, a licensed attorney with Meyers, Hurvitz, Abrahams, LLC in the Washington DC metro area, talks about the most common tax pitfalls that businesses and individuals have to deal with as well as some of the most complex legal tax issues that can have some dire consequences.

Stay In The Know

Get the tax information from a legal perspective you need to stay ahead of the game delivered straight to your inbox. Subscribe to our newsletter for free.

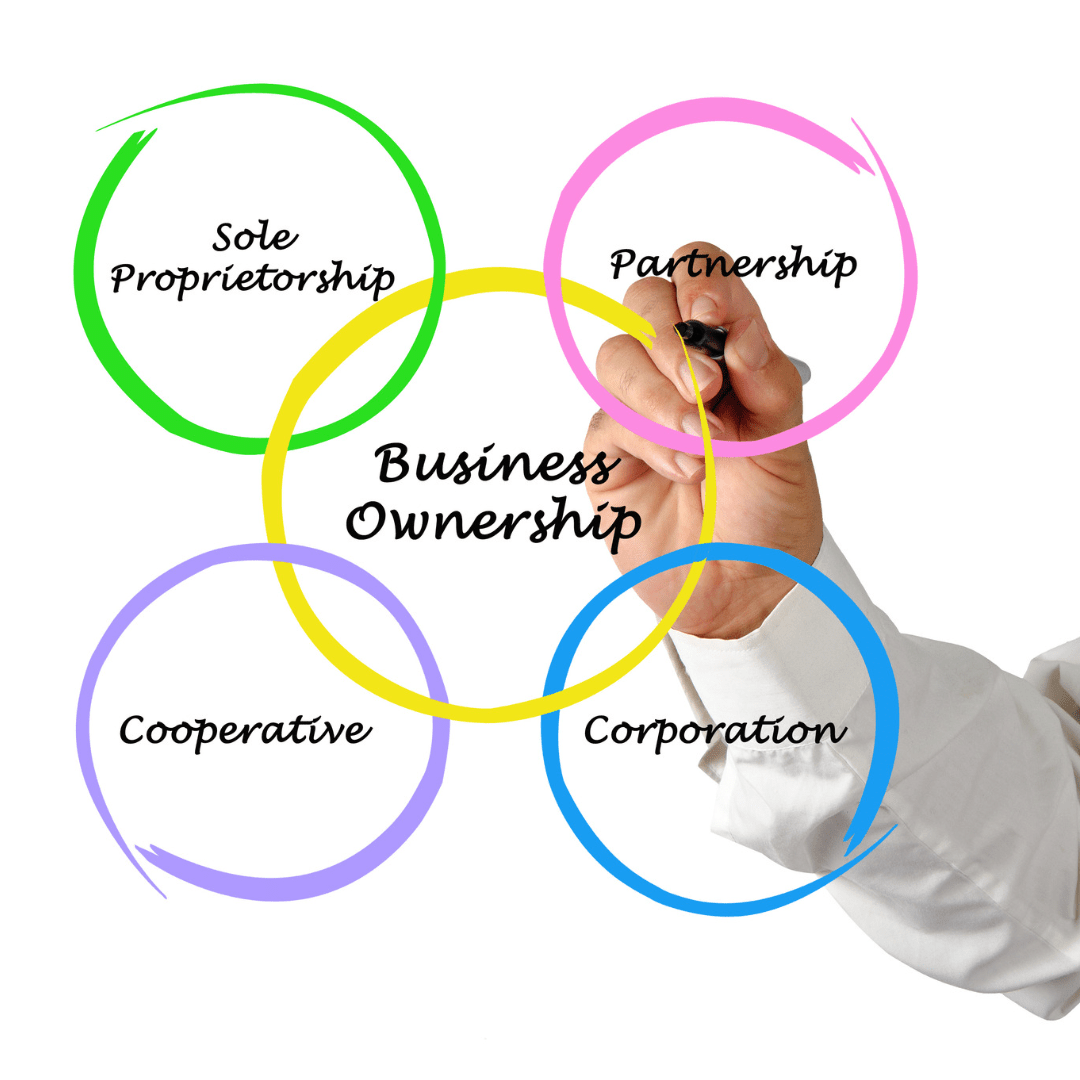

10 Factors in Choosing a Business Entity

If you’re forming a business entity, congratulations! There’s more than just filing your one-page document with the government, setting up your website, and waiting for customers! The type of business entity should fit your particular set of business circumstances. Failure to understand the effects of a particular entity choice and can have adverse consequences for your business. In this episode, I discuss the Top 10 Factors in choosing a business entity.

Selecting the Business Entity to Maximize Your Tax Benefits (Michelle Burke CPA)

Once you have chosen your business entity, it is crucial to understand that such a choice’s tax ramifications can snowball and affect your future tax liability. In this episode, I discuss business entity selection issues with Michelle Burke, an experienced CPA.

Michelle has over 30 years of experience providing clients with accounting and tax preparation services. In this episode, she shares helpful, reassuring, critical, and often surprising tips you need regarding business entity selection for start-ups and existing businesses looking to change types of entities or to be taxed as a particular type of entity.

Bookkeeping and Tax Controversy with Steve Barber

Business Operations don’t just require the advice or services of a tax attorney or CPA. Keeping accurate and detailed records is essential. In this episode, I discuss bookkeeping dos and don’ts and the effect improper bookkeeping can have on a business owner’s tax liability with Steve Barber, owner of Supporting Strategies, a business bookkeeping service, who has over 30 years of experience in the bookkeeping industry.

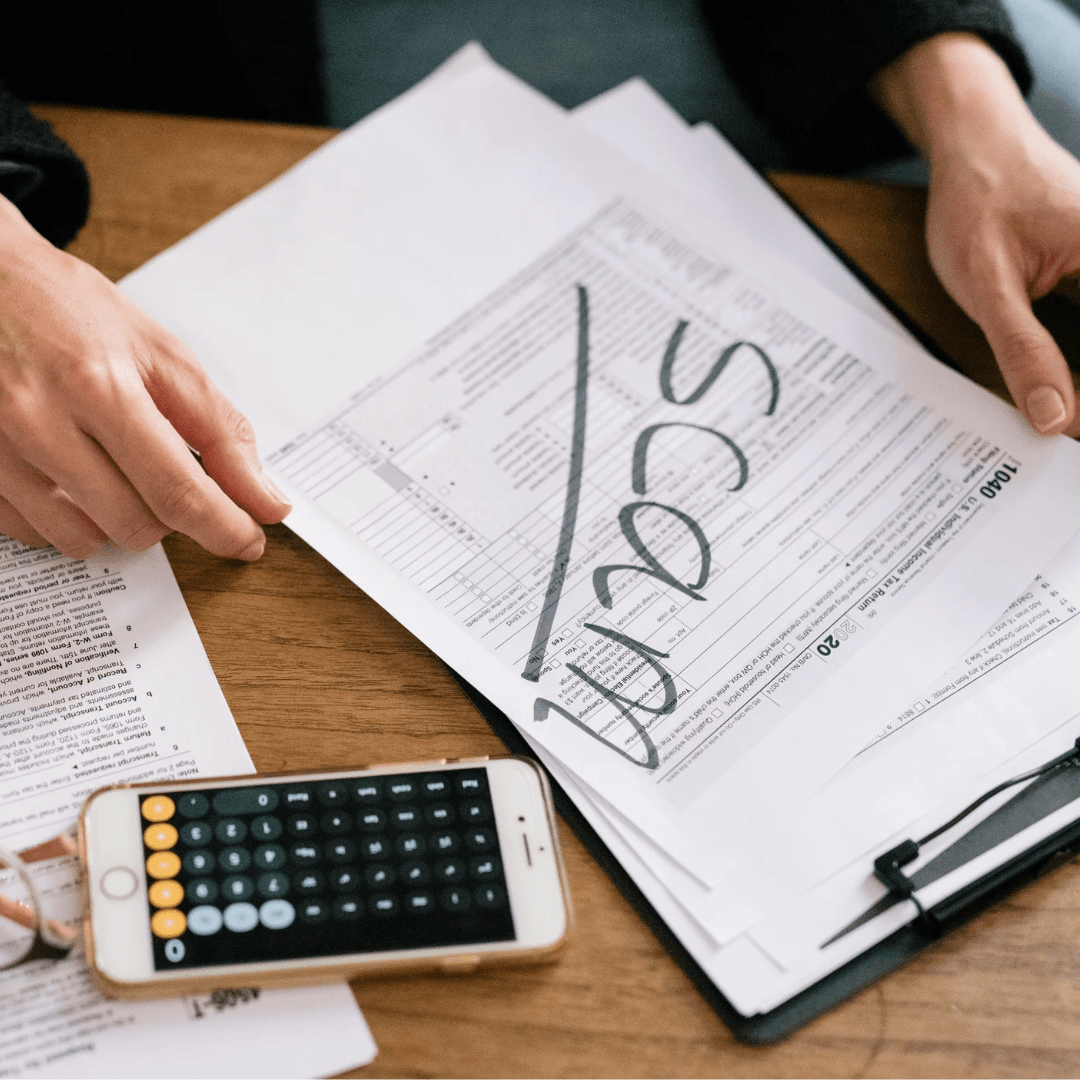

BEWARE of these Most Common TAX SCAMS!

How many times have you received a call from someone claiming that they are from the IRS and you owe money – Worse: If you don’t pay within two days, you are going to jail! Much worse: The person claims to be a member of law enforcement. Catastrophic: You are expecting a tax refund, and the IRS tells you it has already been sent– discovered to be someone else! In this episode, I discuss some of the more common tax scams and how to defend yourself against bad actors who attempt to steal your financial and other confidential information and, in some cases, your complete identity. In many cases, there is substantial financial loss and lost time.

From Prohibition to Progress: Attorney Mike Rothman Shares Insight on Cannabis Laws

Operating Cannabis for medical or Adult Use of the product sounds fulfilling and lucrative. Beware of the legal, tax, financial, and other minefields standing in your way! The issues presented to business owners are daunting enough – now add a layer about Cannabis business operations! In this episode, I discuss such issues with Attorney Mike Rothman, an attorney experienced in Cannabis-related matters.

Cannabis businesses face financial and regulatory hurdles such as banking and congressional action proceeding at a snail’s pace. Have you also considered growing Hemp? Part II of Cannabis business operations focuses on banking, legislative agendas, hemp issues, and related topics. Attorney Mike Rothman joins me again for an insightful discussion that will benefit Cannabis (and Hemp) business owners.

Tax Opinion Letters

In this episode, Adam answers listener questions about Tax Opinion Letters – What is a tax opinion and why might you want one? Surprisingly, many clients and tax advisers have trouble saying exactly just that. Do Tax Opinions Bind the IRS? Are Tax Opinions About Penalty Protection? Should I Get An Opinion if I’m Audited? Do Good Tax Opinions have to be “Strong and Assertive?” Can Assumptions Be About Anything & Do they have to be Reasonable assumptions? Is there any Advantage In Writing Opinions Early? Should I Give the Opinion To the IRS? Should Give the Opinion To the Return Preparer? Are Opinions Helpful In a Dispute? These and other questions are discussed in an attempt to dispel the prevailing myths about Tax Opinion Letters.

Definition of a Closely Held Business

What is a Closely Held Business? You have likely heard the term “Closely Held Business” many times but are unsure what that means! In this episode, I discuss the elements and main concepts of a Closely Held Business, including the advantages and disadvantages associated with such a business.

5 Tax-Related Things Where a Tax Attorney Can be Very Helpful to You and All Your Clients

What does a tax attorney do? When should I hire a tax attorney? Is it necessary to hire a tax attorney if you are in trouble with the IRS? Is the CPA the same as a tax attorney? These questions can seem overwhelming for the average taxpayer. In this episode, I clear up the confusion and provide a roadmap for you to use to know when you need to contact Tax Counsel.

Divorce and Taxes

How does one determine the appropriate tax filing status in the event of a divorce? What are the tax consequences of alimony? Should the parties file a joint return for as long as they are eligible (and what if there is already outstanding tax liability)? How should marital assets be divided? The Legal Tax Junkies shed light on these and hopefully ease the stress during this otherwise difficult time for taxpayers.

Tax Issues related to Elder Care

Can you claim your parents as dependents if you care for them? How are caregivers treated for tax purposes? Are there any particular tax benefits available to the elderly? How are Medicare recipients affected? You may be surprised by what you discover from The Legal Tax Junkies!

Worker Classification

The IRS targets businesses that misclassify employees as independent contractors rather than employees to reduce employer costs and gain a competitive advantage. Businesses also wish to avoid legal liability/taxes such as social security, workers’ compensation, unemployment insurance, payroll, and employment taxes. If an employer-employee relationship exists, the employee’s earnings are subject to FICA (Social Security and Medicare) and income tax withholding. If the IRS determines an individual has been misclassified, it may levy penalties against the employer. These penalties can be costly and, in some cases, devastating for an employer. Find out how to stay out of trouble by tuning in to this episode of the Legal Tax Junkies!

FBARs

Most are unaware that per the Bank Secrecy Act, every year, you must report certain foreign financial accounts, such as bank accounts, brokerage accounts, and mutual funds, to the Treasury Department and keep certain records of those accounts. You report the accounts by filing a Foreign Bank and Financial Accounts report. Failure to navigate this potential tax minefield can result in devastating tax consequences and possible incarceration! Tune in to the Legal Tax Junkies to gain insight into issues associated with foreign asset holdings.

Cryptocurrency Pt 1 – Ins and Outs with Tommy Luginbill

There are many different building blocks of digital assets and particularly cryptocurrency. The different terms and features alone blow your mind away, not to mention the processes, virtual currency exchanges, and security issues. The Legal Tax Junkies sort out the chaos for you with the help of cryptocurrency expert Tommy Luginbill.

Cryptocurrency Pt 2 – Tax Issues with Tommy Luginbill

You are not alone if you are confused about the lack of guidance regarding tax issues in virtual currency. The Legal Tax Junkies bring you up to speed on the tax issues in this new world of commerce. Ignoring these tax issues will result in a significant surprise gift from the IRS! Don’t get ambushed! Listen to the Legal Tax Junkies as we help you navigate the daunting crypto tax environment!

Cryptocurrency Pt 3 – Investment, Reporting, and Estate Planning

There are many pitfalls regarding investments in virtual currency. It gets worse when one fails to consider the reporting and recordkeeping requirements. It becomes untenable when one fails to incorporate virtual currency holdings as part of the estate plan – all the hard work in acquiring virtual currency assets and the financial gain associated addition to that is wasted by not focusing on the tax and other issues associated with leaving these assets to your loved ones. The Legal Tax Junkies will guide you through protecting your virtual currency assets and more!

Frivolous Tax Arguments

Think you can get away with not paying taxes by arguing that tax assessments are unconstitutional? How about claiming that only states can tax income? How about arguing that only government employees only pay taxes? Write “0” all over your income tax return. You may want to reconsider making these arguments to the IRS. The Legal Tax Junkies will provide a comprehensive (but non-exhaustive) list of frivolous tax arguments that, if anything else, will be pretty entertaining!

Section 911 Issues

Do you want to move to the French Riviera, hang out, and do business from your laptop? Be aware of the tax issues of traveling worldwide – at least away from the USA! The Legal Tax Junkies will guide you through the tax minefields of U.S. citizens living overseas – it’s more complicated than you think!

Tax Penalties/Tax Crimes Part I

The IRS has many weapons at its disposal in determining whether it can assess penalties against a taxpayer. The penalty amounts can be overwhelmingly high and serve as a deterrent to taxpayers who think they do not have to file returns or cannot pay taxes, or those who take unreasonable positions regarding their tax liability.

Tax Penalties/Tax Crimes Part II

The IRS Criminal Investigations Division and the Department of Justice have many weapons to deploy against those who commit tax crimes, including tax evasion and money laundering. Know what can happen if you commit various tax crimes. Better yet – read the stories of various celebrities who thought the tax code did not apply to them!

The Secure Act

Retirement Accounts are one of the most important assets we own. Yet very few of us know the tax implications and the rules about distributions, beneficiaries, and timing issues. The Legal Tax Junkies hopes to give you a sense of clarity and alleviate the anxiety generated by this often-confusing subject, where the devil is in the details!

Tax Exempt Entities

Think all you need to do is declare your company a non-profit to enjoy the tax benefits and privileges associated with tax-exempt entities? You may be surprised to learn that there are more issues and rules than may meet the eye. The Legal Tax Junkies will guide you through the process to keep you away from tax trouble!

Section 1202 Corporation Stock Sales

Some taxpayers are staring at a possible tax benefit without even knowing it! You may be entitled to a substantial tax benefit if you own stock in a corporation under Section 1202 of the Internal Revenue Code. In this episode, the Legal Tax Junkies explore corporate stock sales that offer a certain category of eligible taxpayers a generous exclusion of realized gain from recognized taxable gain.